inheritance tax changes 2021 uk

This is at a withdrawal rate of 1 for every 2 over this threshold. The All-Party Parliamentary Group for Inheritance Intergenerational Fairness APPG IIF has proposed to reduce the current charge to IHT from.

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

On 23 March 2021 the government announced that.

. For lifetime gifts there would be no capital gains tax on the. The tax-free dividend allowance has stayed the same for the 2021-22 tax year at 2000. On the 1 January 2022 The Inheritance Tax Delivery of Accounts Excepted Estates Amendment Regulations 2021 came in to force significantly changing the.

Inheritance Tax reporting requirements. On death it has been suggested that there will be no tax free uplift the donee inherits at the donors base cost. Inheritance Tax Rate 2021 The nil-rate band of 325k is likely to change in the March budget as well as changes to rules regarding unused pension pots.

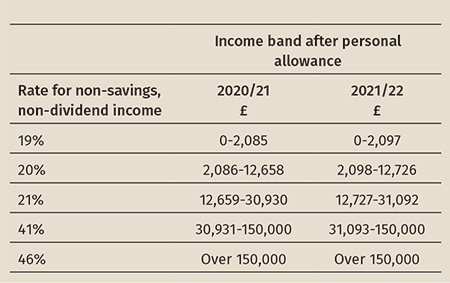

Above this dividend income tax-free allowance you pay tax based on the rate you pay. In 2021 the government implemented changes to the inheritance tax nil-rate band saying that current nil rate bands would remain at existing levels until April 2026. The rate of IHT.

This complexity means that unlike. Tax Day on 23 March 2021 announced that the excepted estates rules would be changed. 22nd March 2021.

Inheritance Tax or IHT is a complicated topic with many different factors clauses and conditions to bear in mind. This measure maintains the tax-free thresholds and the residence nil rate band taper available for Inheritance Tax at their 2020 to 2021 tax year levels up to and. The tax is levied on the value at time of death and must be paid before the asset can.

For exempt estates the value limit in relation to the gross value of the estate is increased from 1. The limit for chargeable trust property is increased from 150000 to 250000. Taxes are never popular but Inheritance TaxIHT is arguably subject to more criticism than any other.

A 10 charge to tax. If capital gains tax rates are not aligned with income tax changes should be introduced to the taxation of share based rewards for employees and small business owners. Read a copy of the government response to the first OTS Inheritance Tax review.

There is a tapered withdrawal of the additional nil-rate band for estates with a net value of more than 2m.

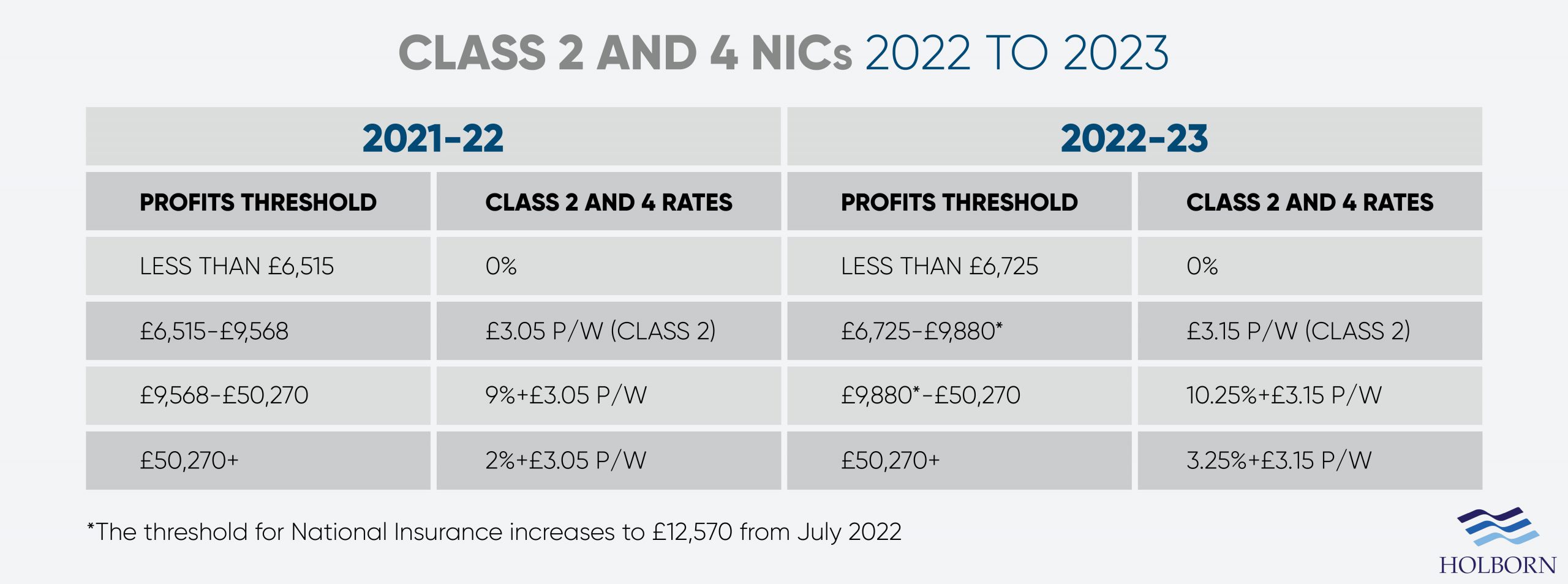

Changes To Uk Tax In 2022 Holborn Assets

Uk Inheritance Tax Collection Reaches 6 Billion Blevins Franks

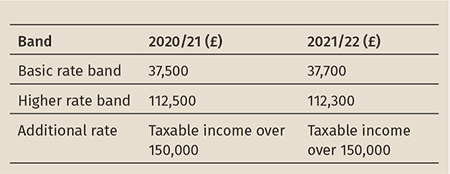

Buying Residential Property In The Uk J P Morgan Private Bank

Inheritance Tax Advice For Expats And Non Uk Residents Expert Expat Advice

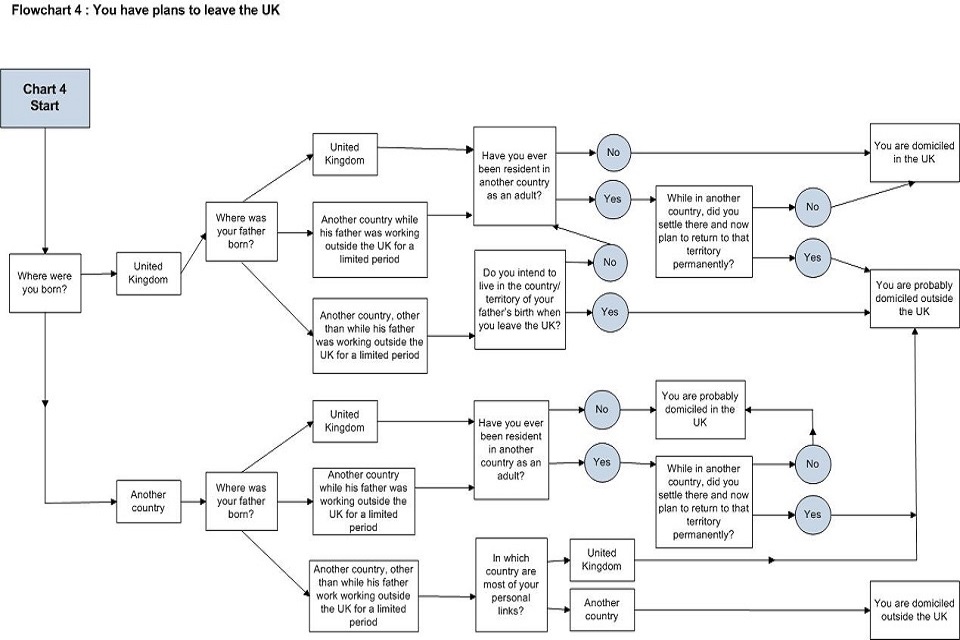

Moving To The Uk As A Uk Citizen Domicile And Residency Htj Tax

Inheritance Tax Receipts Uk 2022 Statista

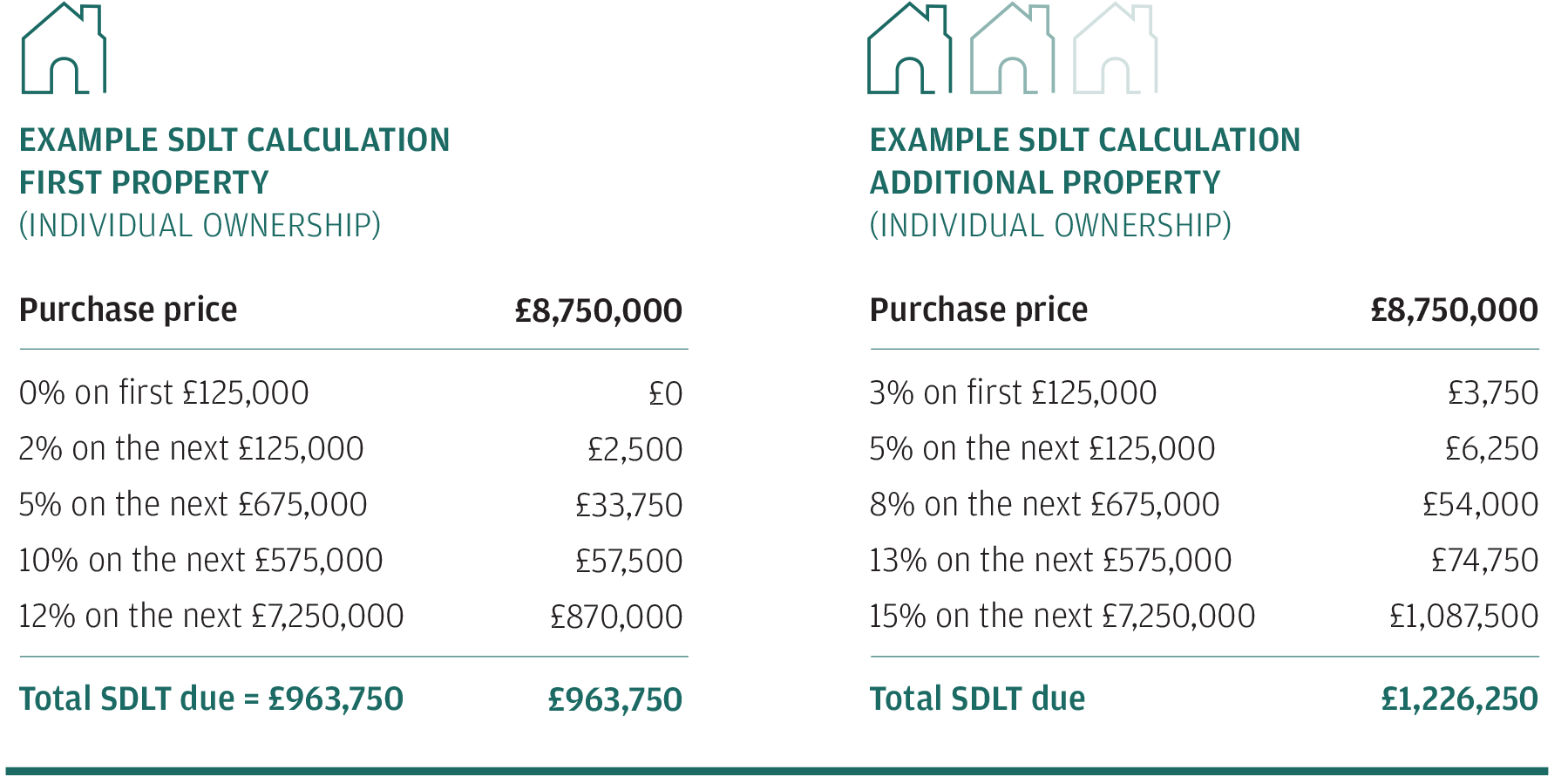

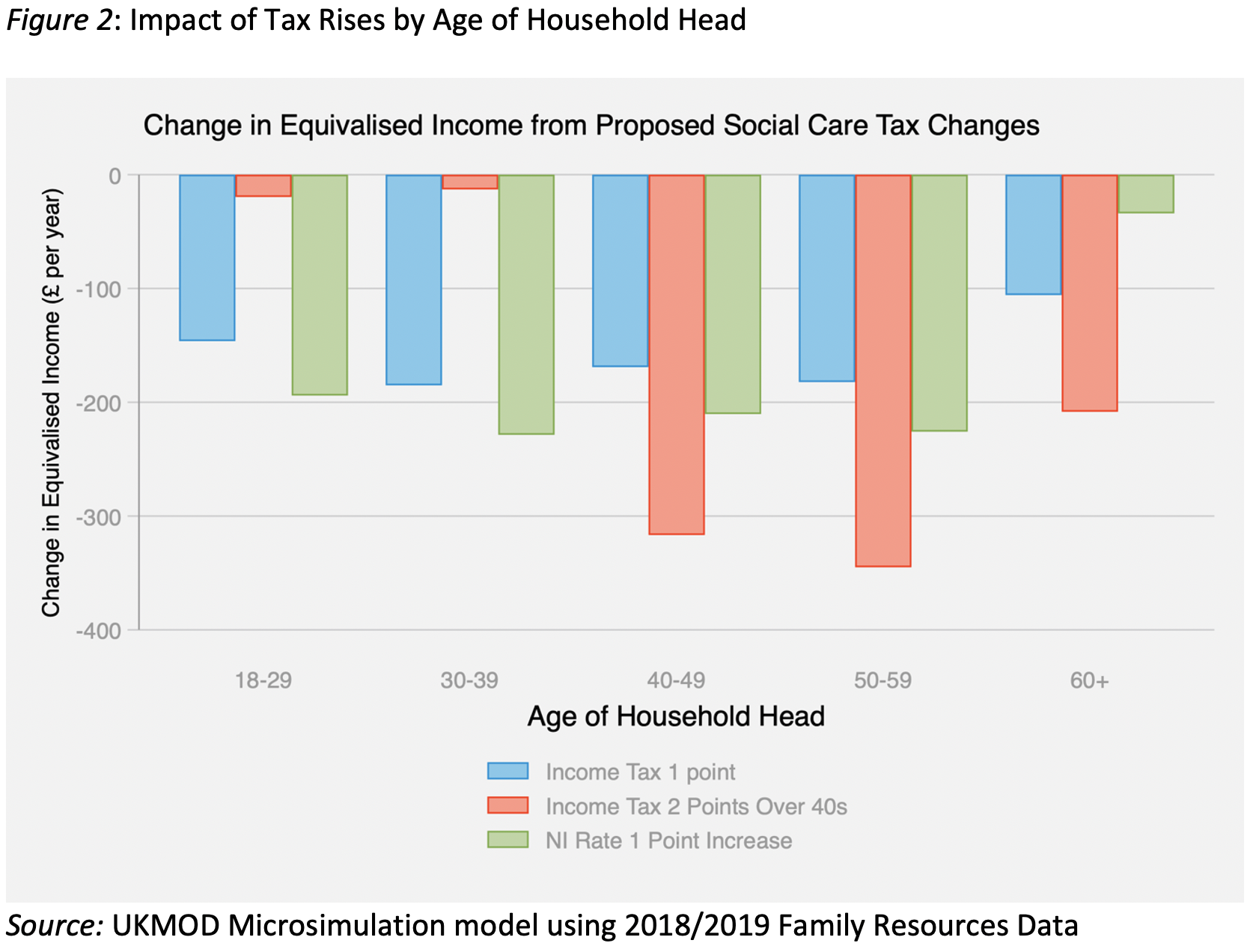

Young People Without Rich Parents Will End Up Paying For A Rise In National Insurance To Fund Social Care British Politics And Policy At Lse

Inheritance Tax Receipts Uk 2022 Statista

Budget Summary 2021 Key Points You Need To Know Budgeting Business Infographic Income Support

Changes To Uk Tax In 2022 Holborn Assets

Moving To The Uk As A Uk Citizen Domicile And Residency Htj Tax

Young People Without Rich Parents Will End Up Paying For A Rise In National Insurance To Fund Social Care British Politics And Policy At Lse

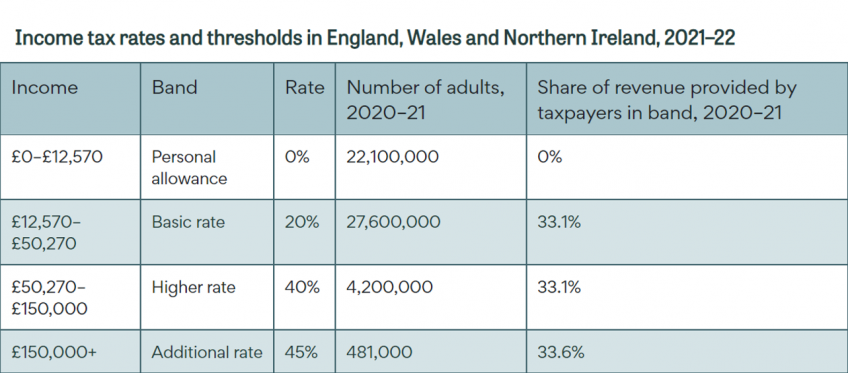

Income Tax Explained Ifs Taxlab

Expat Guide To Buying Property In Florida Https Www Moneyinternational Com Expat Guide Buying Property Florida Fl Buying Property Orlando Theme Parks Expat

Uk Will Form Template Format Sample Forms Templates Will And Testament Last Will And Testament

How To Avoid Inheritance Tax In The Uk 7 Legal Loopholes To Cut The Cost